Best Peer to Peer Sites In The US

More and more consumers want to cut out Banks and credit card companies and lend directly to each other. Peer-topeer lending is one form of crowd financing and investment used to finance loans that are repaid with interest.

Peer-to-peer lending allows potential borrowers to request loans from other individuals and set the terms of these loans. Potential lenders then have the option to fund the loan or not, taking on the potential for reward that comes with lending money. Generally speaking, peer-to-peer lenders and borrowers meet through a peer-to-peer lending website.

Lending through Peer-to-Peer Platforms

For investors with money to lend, peer-to-peer offers excellent returns. Typically, they would register with an entity that advertises for borrowers. When a borrower arises that they would like to lend their money to, the entity facilitates the process, delivering the money to the borrower and the monthly payment stream to the lender.

Read also: How Much Do You Make With P2P lending?

Suggestions for the New Investor

Peer-to-peer lending can be a bit daunting at first, if the investor isn’t used to direct interaction with the recipient of his or her investment. This is a crucial part of the P2P model, and it may take some getting used to it. Some advice to help get started:

Choose your system. Depending on the P2P provider, you may be able to choose between an automated plan, where funds are dispersed automatically, according to the investor’s preset criteria or to invest in loans on an individual basis. Investors report that the returns on individual loans are generally higher than the automated programs. Check with the P2P provider for more information.

Use the filters provided. Each P2P system offers a set of filters that enables the investor to select only the criteria he or she wishes to see. This will streamline the process of locating only borrowers that the investor wishes to fund, without having to evaluate all available borrowers.

Start slowly and small. If the investor has decided that he or she wants to invest $5,000, and you have 20 borrowers chosen, don’t start out with investing $250 into each one. Start with $100, $50 or even $25 at first. Wait a week or two, and then check out more borrowers in which to invest.

Choose wisely. Thoroughly read the details provided for each borrower. Don’t be afraid to ask questions. A borrower with a high credit score might not have as high a return as a borrower with a low credit score, but be mindful that the borrowers with the lowest credit scores also have the highest default rates.

Spreading your investment around evenly between high and low risk borrowers is just like diversifying between the stock market and government bonds.

Investing in peer-to-peer lending can be a very rewarding experience. The investor can interact with the borrower during the funding process, which can provide the investor with insight into the character of the borrower.

The ability to diversify even a large amount into very tiny portions can provide an advantage when it comes to risk management. As with high and low risk investments, there will be high and low risk loans, each with an inverse proportion of potential profit. Spreading money around lowers the overall risk, and increases the potential returns.

Read also: The full P2P lending guide

The Best Peer-To-Peer Lending Websites

Each P2P provider has certain requirements for investors, as well as plenty of restrictions, depending on location. Check with the P2P provider to determine what regulations and restrictions apply in your case. Generally, investors must meet the following criteria:

- Investors from certain states are not allowed to participate, due to state-level regulations.

- Investors must show a minimum net worth, a minimum income or a combination of the two. Income and net worth restrictions may be different in certain states, even when participation is allowed.

Here is the best peer to peer sites in the US and biggest peer-to-peer lending platform on the web to invest or borrow.

Prosper

Prosper is one of the oldest, largest and most respected peer-to-peer lending sites online. Over 1.2 million people have joined the site, and the total amount of money that has been borrowed through Prosper.com is approaching $300 million.

Prosper.com rates loans on a scale from AA (the lowest risk loans) to HR (the highest risk loans). Borrowers can select terms of up to five years, and they can borrow up to $25,000 through the site.

Lenders can choose to fund individual loans, or they can buy notes that represent loans, much as investors on the stock market buy shares of mutual funds.

Currently, Prosper.com is the most widely accessible peer-to-peer lending site. Only Iowa, Maine and North Dakota do not allow residents to use the services that the site offers.

Founded in 2005, the website has over 2 million members and has financed over $5 billion in loans so far. The platform functions in a manner comparable at Lending Club, but not identical.

A few of the investors are big concerns, this institutional participation is very important in itself as peer-to-peer lending is rapidly growing. Large institutional investors are becoming more actively involved on the financing side. Prosper makes private loans for sums of between $2,000 and $35,000.

Loan conditions vary from 36 months to 60 months, with rates of interest between 6% APR and 36% APR. The loan rate is calculated on the basis of your Prosper rating, which is comparable to Lending Club's credit level and is based on your credit rating and loan profile, loan term and loan amount.

Unlike Lending Club, loans are fixed rate quick installment loans, meaning that the debt will be fully paid by the end of the loan period. Once more, the whole procedure takes place online where one can complete a program within a few Minutes.

There are no prepayment penalties, and no hidden fees, although Prosper does charge origination fees. Since financing is done in tiny amounts from several investors, the loan won't fully fund until there's sufficient interest from enough investors. But that process can happen in 1 or 2 days.

Read also: Peer to Peer Lending Vs Stocks

Lending Club

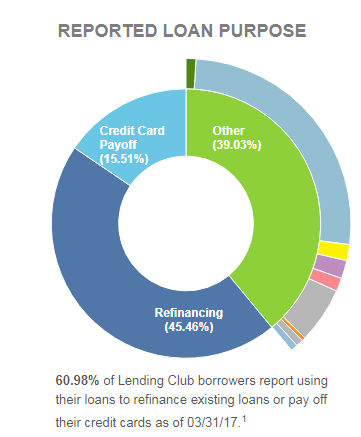

LendingClub is another large peer-to-peer lending site. Since 2007, the site has facilitated nearly $500 million in loans, and investors have received over $40 million in interest payments. The vast majority of borrowers who use this site borrow money to consolidate debt and pay off their credit cards, and the site has a rating system to help lenders understand the risk of investing in each loan.

Those who are interested in saving for retirement are likely to be interested in LendingClub.com, as investors can open a no-fee IRA with the site that allows them to invest in notes that represent LendingClub.com loans.

Investors also have the option of funding individual loans. Borrowers with excellent credit can get a personal loan with an interest rate that is less than 7 percent, which is far lower than most standard bank loans.

Lending Club started at the end of 2007 and by 2015 the website financed nearly $16 billion worth of loans including more than $2.5 billion in the previous quarter of the year.

Lending Club is a peer-to-peer website which brings investors and borrowers together to put together loans which may benefit both parties. The whole application process takes place on the website and may be finished in a matter of minutes.

Once you apply for financing the website allows you to monitor your credit score. The debtors’ credit card debt utilization rate decreases after a few credit cards are consolidated into one loan on the platform.

Lending Club makes personal loans of up to $35,000 and terms vary from 24 months to 60 months after which your debt is totally paid.

Rates of interest vary from 5% APR to a 31% APR which can be dependent on your credit level. Credit rates depend on your credit rating and credit profile as well as by your income along with the amount and term of the loan.

The platform also charges an origination fee of between 1% and 5% of the loan amount which you're borrowing. These origination fees aren't uncommon in the personal loans space and may still result in APRs which are much lower than those charged by credit cards. But there are no application fees and no prepayment penalties. Lending Club's secondary market allow investors to sell loans from their Lending Club account

Upstart

Upstart is the latest newcomer to the list of peer to peer sites. Upstart started operations in the year 2014 but has recently funded more than $300 million in loans. One of the major peer-to-peer lenders, Upstart has the most in common with SoFi.

Like SoFi Upstart takes a closer look at non-conventional standards which includes consideration of the school you attended, the region of study, your academic performance, and your work history.

They do also take more conventional peer-to-peer lending standards like income and credit into consideration. The principal focus is on looking to recognize what they refer to as near prime borrowers.

For that reason, the platform carefully assesses factors that contribute to the future monetary stability and also makes loans accordingly. For instance, Upstart reports that the typical debtor on the platform has a FICO score of 691 and ordinary income of $106,182.

Borrowers who refinance credit cards are usually improving their financial situation almost instantly as a consequence of lowering their rates of interest, reducing their pay per month, and switching revolving debt into an installment loan.

Loan amounts vary from $3,000 to $35,000 with terms of 3 years to five years and have no prepayment penalty. The website claims that their rates are 30 percent less than those of other lenders.

Upstart reports that rates average 15% on a 3-year loan, even though they can vary from 4% to 26% for 3-year loans and 6% to 27% for five-year loans. Like another peer-to-peer lenders Upstart also charges an origination fee which may vary between 1% and 6% of the loan.

SoFi

SoFi, which is short for Social Finance, became one of the leading sources for student education loans, even though they also offer mortgages and personal loans. The platform was established by individuals who're close to the college arena, and well familiar with student loan refinances.

However, this implies that loan approval isn't strictly based on credit or income. The education related criteria weigh heavily in the decision. This is crucial because student education loans are granted on a nearly automatic foundation. The website claims that a typical member may save an average of $14,000.

Currently, the student loan refinances has rates from 3% APR to 7% APR on fixed rate loans and between 2% APR and 5% APR on variable rate loans. You could also refinance the entire amount of student loan debt that you have since the site doesn't indicate the maximum loan amount.

You may refinance both personal student education loans and federal student education loans, though the website recommends that you be cautious in refinancing national loans. It is because national loans come with specific protections that aren't accessible with personal loans.

PeerForm

Borrowers may be especially interested in PeerForm.com because they can get some of the lowest interest rates in the peer-to-peer lending industry. Low-risk borrowers can take out a loan with an interest rate as low as 4.5 percent, and high-risk borrowers will never pay more than 27 percent a year on their loans.

Investors who are interested in funding peer-to-peer loans have the opportunity to ask questions of potential borrowers during the loan application process, but not every person can invest through PeerForm.com.

All interested investors must fill out an application, and only those whom PeerForm.com deems accredited investors will be allowed to join the community of lenders.

PeerForm is a peer-to-peer lending platform which has been established in 2010. The website is more tolerant on credit scores in that they'll lend to borrowers with scores as low as 600. Similar to the other peer-to-peer platforms, you begin by completing an easy online application that takes no more than a few minutes.

Read also: Peer to Peer Lending for Bad Credit

You select the sort of loan that you would like, and also the amount, and after that, your request is set in a loan listing on the website. That's where investors opt to fund your loan. As soon as they do, the info you provided in your application is confirmed, and the financing process begins.

Rates of interest vary from 6% to 29%. Nevertheless, the origination fee is between 1% and 5% of the loan amount. There are no application fees and no prepayment penalties. The loans are unsecured and require no collateral.

Funding Circle

FundingCircle is one of the newest websites that connects borrowers and lenders for peer-to-peer lending. This site is based in the United Kingdom, and it focuses on business peer-to-peer lending. Lenders have the option of buying parts of loans from other lenders, or they can choose to make loans to individual business borrowers.

Thus far, lenders have earned an average gross yield on their money of over 8 percent. Borrowers can repay their loans in their entirety at any time before the end of the loan term without a penalty.

Funding Circle is a peer-to-peer lending site for those who want to get a business loan. This is very important since the small company marketplace is totally underserved by the banking market.

Not only do banks typically have extensive requirements before they'll make a loan to a small business, but they also have a preference for peer-to-peer lending to larger businesses which are better established. The platform has made over $2 billion in loans to over 12,000 small companies.

With Funding Circle, you can borrow as little as $25,000, to just as much as $500,000 on business loans at rates which start as low as 5%. Payment terms are fixed rate and vary from 1 year to five years. And naturally, Funding Circle also features an origination fee, that's typically 5% of the loan amount you're borrowing.

You can get a loan for business purposes, including refinancing existing debt, buying equipment or inventory, moving or expanding the operating space or to hire more employees.

The application procedure takes no more than ten minutes, and you're able to receive financing within 10 days. The entire procedure takes place on the internet and you'll be assigned your Account Manager to help guide you throughout the procedure.

Kiva

While Kiva is more a social lending site, its awesomeness got it onto our list. Kiva.org is a unique site in that lenders do not earn a return on their loans. Instead, the site helps meet the needs of the working poor around the world who do not have access to loans.

Read also: What is Social Lending?

Essentially, this site allows individuals to donate to others and receive their money back without a return. Those who are interested in increasing their charitable contributions will want to visit this site.

Read also: International Peer to Peer Lending Sites

If you apply for a loan on both platforms, Lending Club may offer you a lower interest rate than Prosper.