-

wartonja323 replied to discussion EstateGuru is updating its pricing listEstateGuru ist eine Peer-to-Peer-Kreditplattform, die sich auf durch Immobilien gesicherte Darlehen spezialisiert. Nutzer berichten über attraktive Re

-

Leviati replied to discussion Already invested in Estateguru?Easy registration. Secure transfers but it takes time to be reflected in the wallet. Few debt collection guarantees; The deadline for recovery of over

-

LoneWolf replied to discussion Already invested in Estateguru?It's a bit strange...you have to keep a close eye on whether it's worth staying with it. The fact that the borrowers are currently being given so many

-

Rebelious replied to discussion Already invested in Estateguru?I find good projects in progress there. Beautiful buildings to complete. Their platform is well made, simple to use. Attractive returns

-

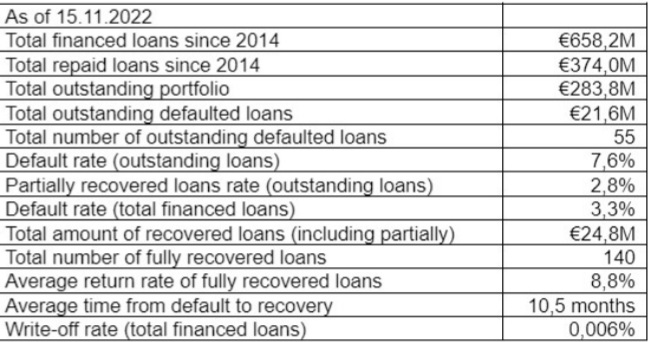

canythould43 replied to discussion Already invested in Estateguru?The default rate of EstateGuru's loan portfolio has ascended to 14.9%, with Finland and Germany experiencing the highest defaults reaching levels of 3

-

canythould43 posted a new discussion Loan portfolio overview (June 2023)The loan origination volume for June was €6,3M, which brought the total for the first six months of 2023 to €44,1M. Last month the country volumes wer ...

-

canythould43 posted a new discussion EstateGuru reports optimistic originations despite default concernsEstateGuru has reported that its monthly loan origination volumes have remained “constant” at around €8m, as it pledges to reduce its default rate to ...

-

-

canythould43 posted a new discussion EstateGuru is updating its pricing listThe platform raised the Secondary Market fee to 3% for sellers. Furthermore, EstateGuru will charge €10 for inactive accounts from April 2 ...

-

canythould43 posted a new discussion EstateGuru obtained the European Crowdfunding Service Providers LicenseOn the 8th of May, the Financial Supervisory Authority in Estonia issued a license to Estateguru to operate as a provider of crowdfunding services, ...

-

canythould43 posted a new discussion EstateGuru informed investors about the recovery timeline for defaulted projectsEstateGuru informed investors about the recovery timeline for defaulted projects in various countries. In Estonia and Lithuania, the enforcement pr ...

-

On the 8th of May, the Financial Supervisory Authority in Estonia issued a license to Estateguru to operate as a provider of crowdfunding services, giving it the right to provide loan mediation and investment-based crowdfunding services across Europe. Due to that, investors will start to see a more aggressive debt management policy, and receive more information about new investment projects and their portfolio on EstateGuru, including ratings, statistics etc.

-

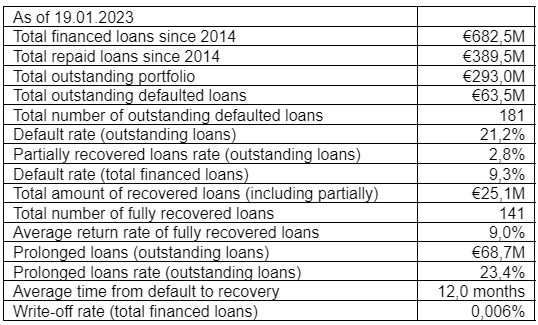

canythould43 added a new photoDuring the first month of 2023, the platform saw €9,6M worth of funded projects. Estonia and Lithuania each accounted for 1/3 of the total volume, followed by Latvia and Finland. No new projects are being introduced in Germany for the time being, while Estateguru put all focus on recoveries.

Repayments were at €7,8M. ¡The average return was 8,0%, with a total of 46 loans (including stage loans) repaid. -

Estateguru 2022 results: revenue increased by 12%, new investors by 37%, loan volumes decreased 10% compared to 2021.

2022 turned out to be a turbulent year, with rising inflation, market disruption, increased geopolitical risk and soaring interest rates. The total funded amount, on the platform, for the year was €183M, which is a 10% decrease when compared to 2021 (€203M). The current outstanding portfolio amounts increased from €220,3M (at the end of 2021) to €291M as of the end of 2022. Peerberry revenues were €8M in 2022, an increase of 12% compared to 2021 (€7,1M) -

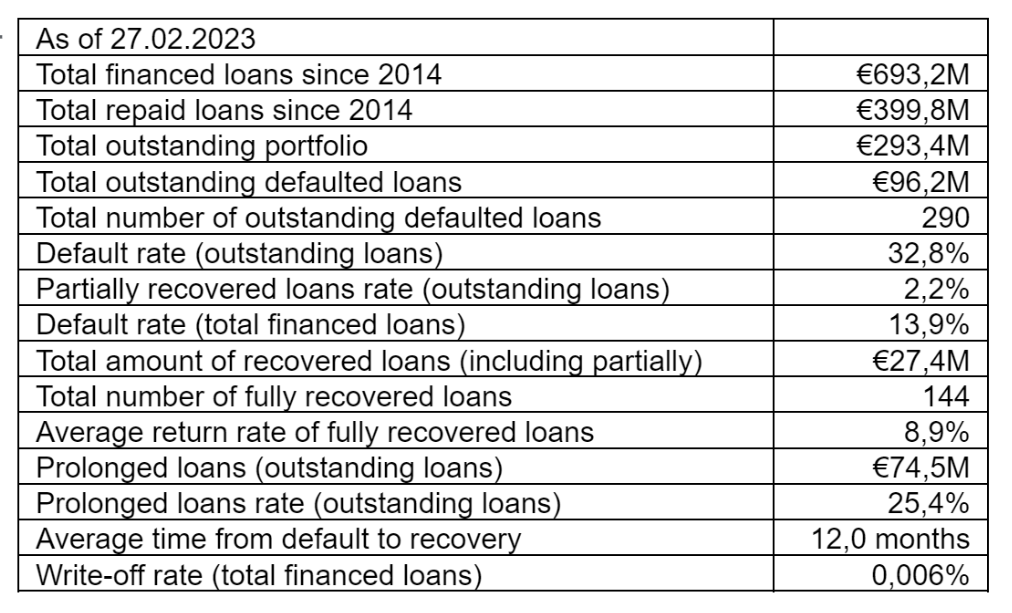

canythould43 added a new photoThe default rate has increased significantly when compared to the beginning of 2022, due to new defaults in Germany and Finland. German and Finnish default and late projects received the most attention last year.

With €11,8M produced in December. Estonia was the best performing market in terms of volume, in December (€5,3M), and also in 2022 overall (€69,2). Finland followed with €2,2M (€22,0M for the last two years), while Latvia produced €23,6M (annual growth of 19%) in 2022 and €2,0M in December. The Lithuanian yearly volume was the same at €34,5M (including €2,0M in December) and German origination dropped over two times to €33,7M (€0,2M in December) -

-

canythould43 added a new videoBaltic Real Estate Market Overview During the webinar our experts discussed the state of the real estate market in the Baltic countries and described scenarios around how the global mac ...

-

canythould43 added a new videoQ&A Session with Andres Luts and Daniil Aal - November 2022 Thank you for sending us over 90 questions!

-

Decreased funding volume, loan repayments and default rate

EstateGuru's funding volume decreased to €13.8 M last month. Investors received €7.5M worth of principal. The default rate of EstateGuru's outstanding portfolio decreased to 7.75%, mainly due to the recovery of one Finnish loan (€2M). EstateGuru expects the recovery of the first defaulted loan in Germany (€2.5M) by December and the recovery of the largest Spanish defaulted project (€1.8M) during November. -

canythould43 added a new videoBaltic Real Estate Market Overview During the webinar our experts discussed the state of the real estate market in the Baltic countries and described scenarios around how the global mac ...

-

canythould43 posted a new discussion Already invested in Estateguru?Already invested in Estateguru? If so, share your impressions below. Are you happy with Estateguru? Have you encountered an issue that other invest ...

-

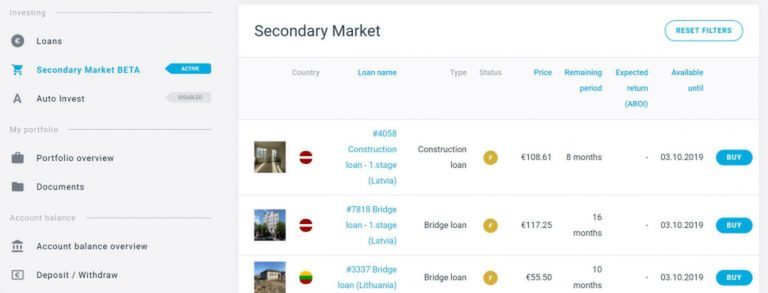

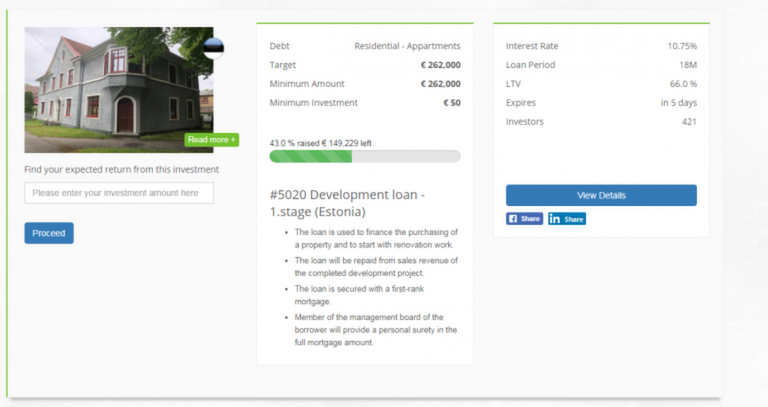

canythould43 added a new photoSince September 2019 we finally have secondary market in Estateguru! , so that we can finally sell our shares to other users whenever we want and buy new operations at very interesting prices. Keep in mind that there is a 2% commission for sales in the secondary market (purchases have no commission).

-

Estateguru does not offer buyback or buyback guarantee on its loans, but precisely because of the aspect just mentioned - the LTV as a measure of the degree of protection of the loan with the mortgage guarantee -, the buyback has no reason to be in Estateguru: there is no need of it because the loans are already covered with the corresponding real estate property, which will be sold in case of default.

-

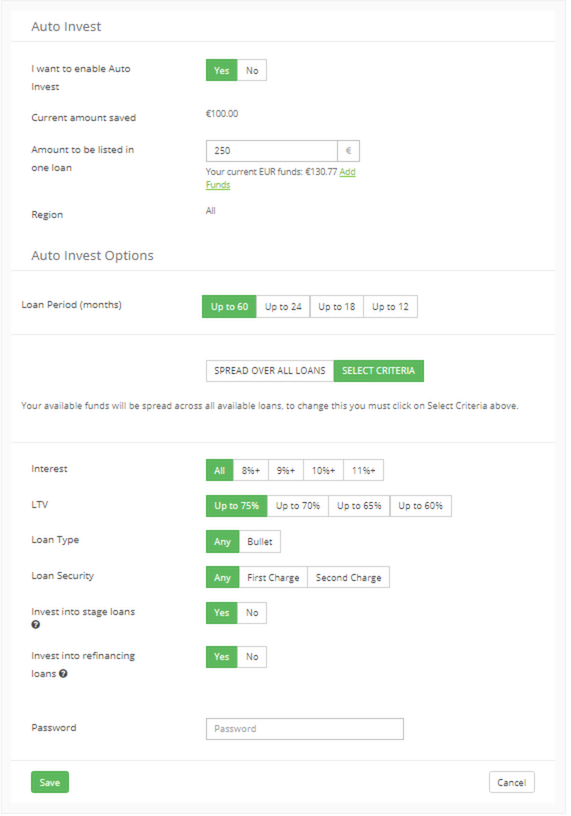

canythould43 added a new photoIn platforms focused on real estate loans, generally with fewer loans and greater amount of them compared to other marketplaces, the option of self-investing to manage our portfolio is not critical as critical, although in the case of Estateguru, it will help us do not miss out on new investment opportunities.

-

One of Estateguru's strengths is that its average LTV is only 59% , which is downright good (even loans with 70% LTV - 75% can be considered relatively safe). The LTV (Loan to value or “relationship between loan and mortgaged value”) is the key parameter of the loan that indicates the relationship between the amount of the loan requested by the borrower and the value of the mortgaged asset offered as collateral or guarantee .

-

-

canythould43 added a new photoIn Estateguru we can invest in two ways: manual and automatic (Autoinvest). Manual investment is the most common method on this platform: we will observe the available projects, analyze the parameters of the investment in the property and decide the amount to invest from 50 euros.

-

Estateguru already has more than 20,000 investors from almost 50 different countries, with a turnover of more than 100 million euros borrowed and historical profitability exceeding 12% ...

-

This particularity that all loans have a real estate guarantee makes it a much safer investment model than other crowdlending equivalents , since if the loan fails, the property presented is sold as collateral to repay the credit and interests.

-

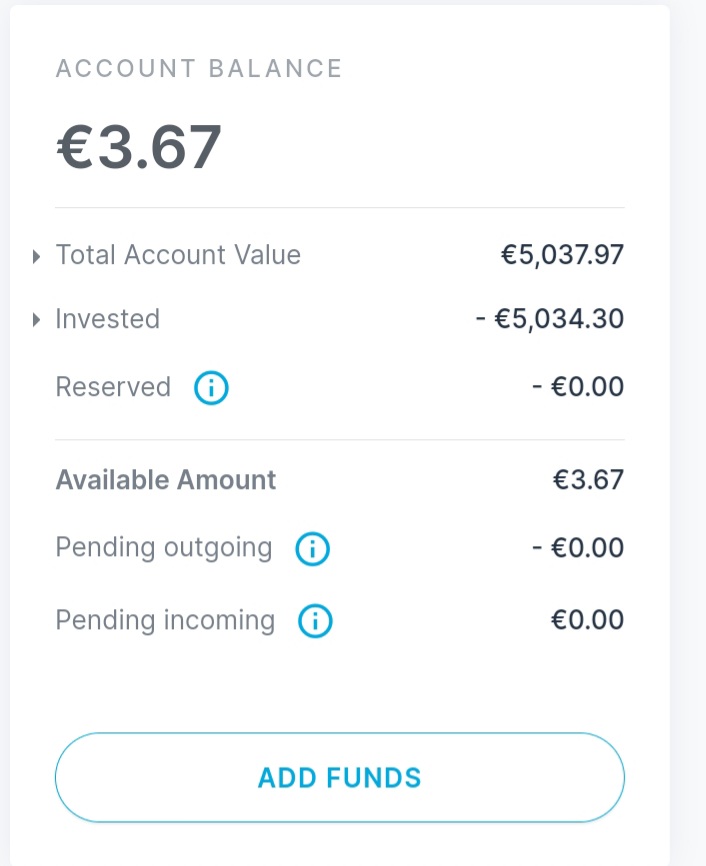

canythould43 added a new photoEstateguru is a European global marketplace in which solvent companies come to request financing by providing real estate (apartments, villas, housing developments, plots ...) as a mortgage guarantee .

-

Estateguru is a platform based in Estonia that has been very strong in 2020, being a pan-European leader in loans with real estate collateral . A real asset to consider in our crowdlending and P2P investment portfolios!

EstateGuru ist eine Peer-to-Peer-Kreditplattform, die sich auf durch Immobilien gesicherte Darlehen spezialisiert. Nutzer berichten über attraktive Renditen und die Möglichkeit, in verschiedene europäische Immobilienmärkte zu investieren. Allerdings besteht das Risiko von Kreditausfällen und Marktvolatilität. Die Plattform wird für ihre benutzerfreundliche Oberfläche geschätzt, aber Investitionen sind nicht so liquide wie traditionelle Anlagen. Suchen Sie hier nach Estateguru-Erfahrungen: https://rethink-p2p.de/estateguru-erfahrungen/

Easy registration.

Secure transfers but it takes time to be reflected in the wallet.

Few debt collection guarantees; The deadline for recovery of overdue debts is undefined. I started last year, exactly in December, I have invested in 24 projects of which 40% are delayed and some of them are already considered lost, (until the property is sold I will not see a penny) that is, that if it is not sold they will not even return the loan to me.