-

canythould43 a ajouté une nouvelle vidéoPeer-to-Peer Lending in Europe via Monestro Explained in One Minute For many years since the launch of Prosper over in the US, it has bothered me that as Europeans (I'm from Europe btw), we were way behind in terms of ...

-

canythould43 a démarré une nouvelle discussion Already invested in Monestro?Already invested in Monestro? If so, share your impressions below. Are you happy with Monestro? Have you encountered an issue that other investors ...

-

The Monestro Pros and Cons.

PROS

-0% default rate and no late loans for more than 90 days

-Competitive lender returns rates up to 30%

-Monestro team members have been involved with banking and the financial market since 1992

CONS

-Not sufficient track record

-Money transfer takes up to 5 working days

-No buyback guarantee and provision fund -

Not that Monestro has commissions, it has a small commission for each withdrawal we make (in this case 40 cents), small commissions for purchases and sales in the secondary market … and for each Auto Invest that we activate from the third, we will have to pay … 5 euros! … so do not have more than 3 Auto Invest activated at the same time.

-

In 2016, Monestro obtained the intermediary lender license by the Estonian Financial Supervisory Authority (FSA).

Unlike other platforms of this type, in Monestro they are not loans pre-financed by the originator, but directly links the investor with the borrower. -

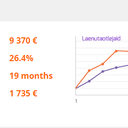

Monestro is a crowlending platform based in Estonia that allows investments with a return of between 8% and 35%. Monestro began operations in Estonia in 2016, and its founders are two professionals in the world of finance. One of its founders, Targo Raus, was working as CEO at Bigbank for 10 years.

-

Like the majority of loan marketplaces among people like Bondora or Finbee, Monestro has NO Repurchase Guarantee on its loans , a fact that it tries to compensate by offering a gross return of starting higher than normal, (an average around 26 %)