-

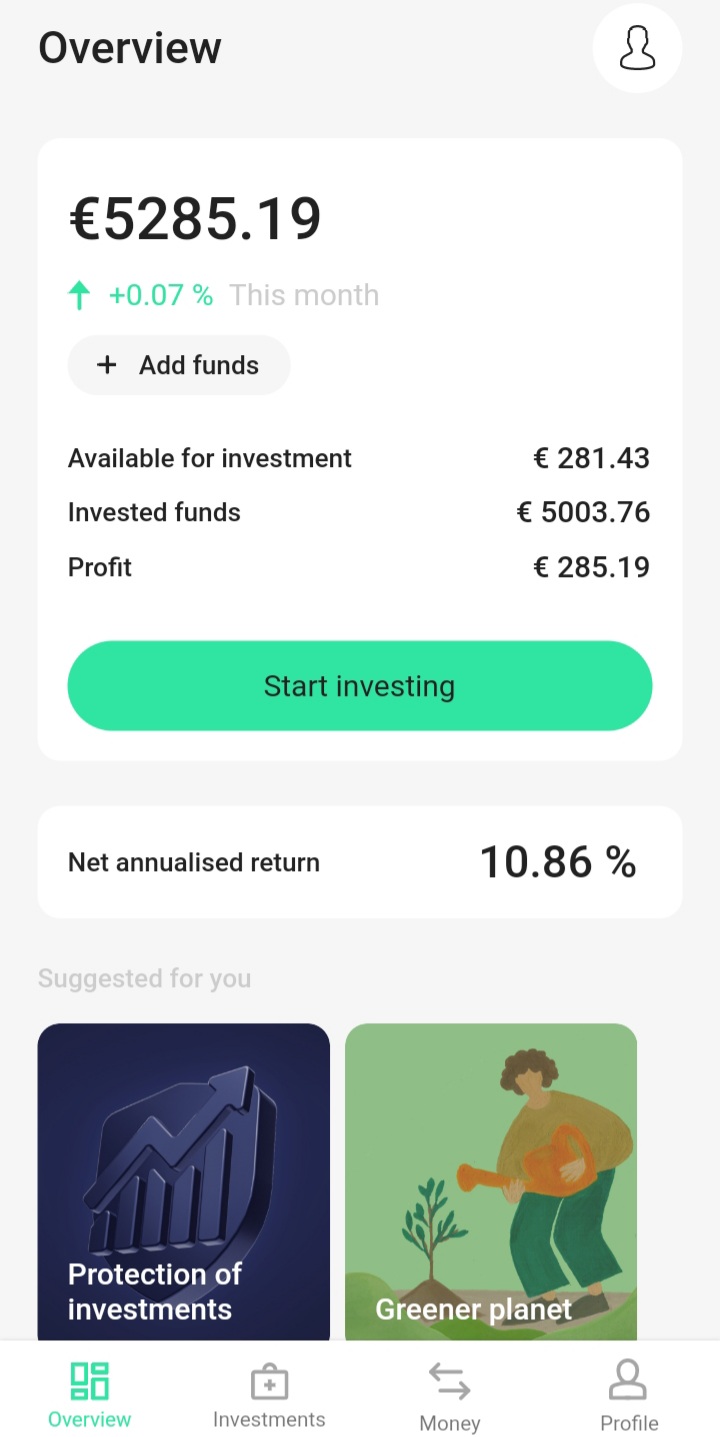

I seek for a personal loan of € 5000. No fees for creating the loan ! No fees of transfer the loan !

-

Bonjour Monsieur et Madame

Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu importe vos soucis, je peux vous aider à retrouver votre sourire. Laissez – moi savoir vos besoins et vous satisfaire dans les 72 heures. Le taux d’intérêt annuel est de 2% et ce prêt est accordé à toutes personnes honnêtes. Je suis disponible à vous octroyer des prêts valables de 1000€ à 900000€ .Je suis disponible à satisfaire mes clients Veuillez juste me contacter par mail

E-mail :

martinebertrand124@gmail.com

martinebertrand124@gmail.com

Pas de sérieux s’abstenir.

--------------------

BERTRAND MARTINE -

Bertrand Martine ha iniciado una nueva discusión OFFRE DE PRÊT TRÈS SÉRIEUX ET HONNÊTEBonjour Monsieur et Madame Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu ...

-

Bertrand Martine ha respondido a Already invested in PeerBerry?Bonjour Monsieur et Madame Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu i

-

Bonjour Monsieur et Madame Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu i

-

Bonjour Monsieur et Madame Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu i

-

Bonjour Monsieur et Madame Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu i

-

Bonjour Monsieur et Madame Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu i

-

-

Bonjour Monsieur et Madame Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu i

-

Bertrand Martine ha respondido a Smartcredito from Spain joins the PeerBerry platformBonjour Monsieur et Madame Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu i

-

Bonjour Monsieur et Madame

Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu importe vos soucis, je peux vous aider à retrouver votre sourire. Laissez – moi savoir vos besoins et vous satisfaire dans les 72 heures. Le taux d’intérêt annuel est de 2% et ce prêt est accordé à toutes personnes honnêtes. je suis disponible à vous faire des prêt valable de 1000€ à 900000€ .Je suis disponible à satisfaire mes clients Veuillez juste me contacter par mail

E-mail :

martinebertrand124@gmail.com

martinebertrand124@gmail.com

Pas de sérieux s’abstenir.

--------------------

BERTRAND MARTINE -

Hallo Herr/Frau

Ich bin eine Finanzgeschäftsfrau, die Ihnen einen schnellen Kredit geben kann. Dies ist ein sehr seriöser und schneller Geldkredit mit einem sehr günstigen Zinssatz, mit dem Sie alle Ihre Geldprobleme lösen können

Bei Fragen kontaktieren Sie mich bitte unter meiner E-Mail-Adresse:

lamacarole849@gmail.com -

Hallo Herr/Frau

Ich bin eine Finanzgeschäftsfrau, die Ihnen einen schnellen Kredit geben kann. Dies ist ein sehr seriöser und schneller Geldkredit mit einem sehr günstigen Zinssatz, mit dem Sie alle Ihre Geldprobleme lösen können

Bei Fragen kontaktieren Sie mich bitte unter meiner E-Mail-Adresse:

lamacarole849@gmail.com -

canythould43 ha iniciado una nueva discusión Smartcredito from Spain joins the PeerBerry platformOne more business partner, Smartcredito from Spain, joins the PeerBerry platform. Smartcredito, launched by Aventus Group, will offer PeerBerry ...

-

I want to get a loan ($15K). is there any real lender?

interest rate : 11%

loan duration: 12 months -

canythould43 ha iniciado una nueva discusión PeerBerry partners in Kazakhstan made EUR 4,7 million in net profit in 2022In 2022, PeerBerry business partners in Kazakhstan made EUR 4,7 million in net profit – significantly more than in 2021 (Aventus Group's ...

-

canythould43 ha iniciado una nueva discusión EUR 42,65M of war-affected loans have been repaid to investorsPeerBerry business partners are repaying EUR 1,8 million of war-affected loans. Under the Group guarantee mechanism in 17 months of the war, PeerBe ...

-

canythould43 ha iniciado una nueva discusión Onecredit from Kazakhstan joins the PeerBerry platform | 11% ROIOne more lender, Onecredit from Kazakhstan, joins the PeerBerry platform. Onecredit will offer PeerBerry investors investments in short-term loans ...

-

-

canythould43 ha iniciado una nueva discusión CashX loans from Sri Lanka are back on the PeerBerry platformStarting this week, CashX loans from Sri Lanka are back on the PeerBerry platform. CashX offers investments into double guaranteed short-term loans ...

-

canythould43 ha iniciado una nueva discusión Peerberry informs about a slight decrease in interest ratesPeerberry informs about a slight decrease in interest rates from June 15 for investing in some loans. Interest on investments in loans from Kazakhs ...

-

Peerberry informs about a slight decrease in interest rates from June 15 for investing in some loans. Interest on investments in loans from Kazakhstan, Moldova, Romania, the Philippines, and Kenya is decreasing by 0.5%. The decrease in interest rates is based on the lenders’ high profitability and/or limited need to borrow. Please note new interest rates considering your investment strategy.

-

canythould43 ha respondido a Already invested in PeerBerry?The demand on the PeerBerry platform is high, and many investors face the issue of investing all the funds held in the PeerBerry account.

-

To avoid risks, PeerBerry suspended the listing of CashX loans on the platform in March 2022 due to the deteriorating economic situation in the country. The company successfully continued developing business with its own funds. Since this year, the economic situation in Sri Lanka has been on a positive development trend, and partner CashX is demonstrating good performance results. To date, the CashX loan portfolio amounts to over EUR 2 million.

-

canythould43 ha añadido una nueva fotoStarting this week, CashX loans from Sri Lanka are back on the PeerBerry platform. CashX offers investments into double guaranteed short-term loans with an 11,5% ROI. Sri Lankan loans will be available on the PeerBerry platform three times a week. First loans will be offered today. Make sure to include CashX company in your Auto Invest if this company's offer meets your investment strategy.

-

PeerBerry and its partner Aventus Group continue a strategy to diversify the business by country and bring more diversity to investors. Today, the Czech lender PůjčkaPlus joins the PeerBerry platform.

The company issues short-term non-bank loans with an average amount of around EUR 300. PůjčkaPlus pays much attention to service innovation and reliable relations with customers. The company lends following the provisions of responsible lending. The Czech National Bank supervises PůjčkaPlus activities.

On PeerBerry, PůjčkaPlus offers investments in short-term loans with a 10,5% annual return. PůjčkaPlus loans include a buyback and a group guarantee. -

Nathlite ha respondido a Already invested in PeerBerry?I have had great profitability and I have had a great facility that other platforms have not given me in making my investments liquid. Easy to use,

-

Cheema ha respondido a Already invested in PeerBerry?Generally; Peerberry is easy to use (in half an hour anyone starts investing and earning income), it works well and has a very certified web design. I

-

Outlawking ha respondido a Already invested in PeerBerry?I have noticed since the beginning of 2023 that the number of loans has decreased enormously. My money is therefore not reinvested and no longer earns

-

-

LoneWolf ha respondido a Already invested in PeerBerry?In my opinion the best P2P Platform that exists. They respond to the chat during operating hours in a very short time and they fix the problem you hav

-

Peerberry is a European P2P lending platform that allows users to invest in consumer and small business loans from various countries. It was launched in 2017 and it is operated by Aventus Group. It offers loans from different originators, diversifying risks for investors. Some of the key features of Peerberry are:

Auto-invest feature

Secondary market for selling loans

Buyback guarantee

Diversification across loans and originators

Low minimum investment

Detailed loan information and statistics -

canythould43 ha añadido una nueva foto en el álbum del grupo PEERBERRY Review: Peer to Peer Lending's Photos

-

canythould43 ha añadido una nueva foto en el álbum del grupo PEERBERRY Review: Peer to Peer Lending's Photos

-

✅ Within 5 years of PeerBerry's operation, our investors funded EUR 1,5 billion in loans.

✅ In total, PeerBerry paid out EUR 17,3 million in interest to its investors. -

✅ At the end of 2022, PeerBerry had 63 471 verified investors.

✅ PeerBerry’s outstanding portfolio amounted to EUR 101,18 million. -

✅ In 2022, PeerBerry investors funded EUR 537,5 million in loans.

✅ In 2022, PeerBerry investors earned EUR 7,16 million in interest.

✅ 14 524 new investors joined the platform in 2022. -

canythould43 ha añadido una nueva foto en el álbum del grupo PEERBERRY Review: Peer to Peer Lending's Photos

-

✅PeerBerry's portfolio of investments exceeded EUR 100M today.

✅This year, the investors have already funded over EUR 500M of loans. -

-

canythould43 ha añadido una nueva foto en el álbum del grupo PEERBERRY Review: Peer to Peer Lending's Photos

-

Vietnamese lender CayDenThan is now listing loans on PeerBerry

CayDenThan VN started offering loans with a 12% annual return, backed by a buyback and group guarantee. CayDenThan VN is a joint venture of Aventus Group and GoFingo Group in Vietnam.

Bonjour Monsieur et Madame

Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu importe vos soucis, je peux vous aider à retrouver votre sourire. Laissez – moi savoir vos besoins et vous satisfaire dans les 72 heures. Le taux d’intérêt annuel est de 2% et ce prêt est accordé à toutes personnes honnêtes. je suis disponible à vous faire des prêt valable de 1000€ à 900000€ .Je suis disponible à satisfaire mes clients Veuillez juste me contacter par mail

E-mail :

martinebertrand124@gmail.com

martinebertrand124@gmail.com

Pas de sérieux s’abstenir.

--------------------

BERTRAND MARTINE

Bonjour Monsieur et Madame

Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu importe vos soucis, je peux vous aider à retrouver votre sourire. Laissez – moi savoir vos besoins et vous satisfaire dans les 72 heures. Le taux d’intérêt annuel est de 2% et ce prêt est accordé à toutes personnes honnêtes. je suis disponible à vous faire des prêt valable de 1000€ à 900000€ .Je suis disponible à satisfaire mes clients Veuillez juste me contacter par mail

E-mail :

martinebertrand124@gmail.com

martinebertrand124@gmail.com

Pas de sérieux s’abstenir.

--------------------

BERTRAND MARTINE

Bonjour Monsieur et Madame

Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu importe vos soucis, je peux vous aider à retrouver votre sourire. Laissez – moi savoir vos besoins et vous satisfaire dans les 72 heures. Le taux d’intérêt annuel est de 2% et ce prêt est accordé à toutes personnes honnêtes. je suis disponible à vous faire des prêt valable de 1000€ à 900000€ .Je suis disponible à satisfaire mes clients Veuillez juste me contacter par mail

E-mail :

martinebertrand124@gmail.com

martinebertrand124@gmail.com

Pas de sérieux s’abstenir.

--------------------

BERTRAND MARTINE

Bonjour Monsieur et Madame

Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu importe vos soucis, je peux vous aider à retrouver votre sourire. Laissez – moi savoir vos besoins et vous satisfaire dans les 72 heures. Le taux d’intérêt annuel est de 2% et ce prêt est accordé à toutes personnes honnêtes. je suis disponible à vous faire des prêt valable de 1000€ à 900000€ .Je suis disponible à satisfaire mes clients Veuillez juste me contacter par mail

E-mail :

martinebertrand124@gmail.com

martinebertrand124@gmail.com

Pas de sérieux s’abstenir.

--------------------

BERTRAND MARTINE

Bonjour Monsieur et Madame

Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu importe vos soucis, je peux vous aider à retrouver votre sourire. Laissez – moi savoir vos besoins et vous satisfaire dans les 72 heures. Le taux d’intérêt annuel est de 2% et ce prêt est accordé à toutes personnes honnêtes. je suis disponible à vous faire des prêt valable de 1000€ à 900000€ .Je suis disponible à satisfaire mes clients Veuillez juste me contacter par mail

E-mail :

martinebertrand124@gmail.com

martinebertrand124@gmail.com

Pas de sérieux s’abstenir.

--------------------

BERTRAND MARTINE

Bonjour Monsieur et Madame

Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu importe vos soucis, je peux vous aider à retrouver votre sourire. Laissez – moi savoir vos besoins et vous satisfaire dans les 72 heures. Le taux d’intérêt annuel est de 2% et ce prêt est accordé à toutes personnes honnêtes. je suis disponible à vous faire des prêt valable de 1000€ à 900000€ .Je suis disponible à satisfaire mes clients Veuillez juste me contacter par mail

E-mail :

martinebertrand124@gmail.com

martinebertrand124@gmail.com

Pas de sérieux s’abstenir.

--------------------

BERTRAND MARTINE

Bonjour Monsieur et Madame

Vous avez besoin d’un prêt pour finir avec vos dettes et sortir de l’impasse ou peut-être pour achever votre maison. Peu importe vos soucis, je peux vous aider à retrouver votre sourire. Laissez – moi savoir vos besoins et vous satisfaire dans les 72 heures. Le taux d’intérêt annuel est de 2% et ce prêt est accordé à toutes personnes honnêtes. je suis disponible à vous faire des prêt valable de 1000€ à 900000€ .Je suis disponible à satisfaire mes clients Veuillez juste me contacter par mail

E-mail :

martinebertrand124@gmail.com

martinebertrand124@gmail.com

Pas de sérieux s’abstenir.

--------------------

BERTRAND MARTINE