-

Hallo Herr/Frau

Ich bin eine Finanzgeschäftsfrau, die Ihnen einen schnellen Kredit geben kann. Dies ist ein sehr seriöser und schneller Geldkredit mit einem sehr günstigen Zinssatz, mit dem Sie alle Ihre Geldprobleme lösen können

Bei Fragen kontaktieren Sie mich bitte unter meiner E-Mail-Adresse:

lamacarole849@gmail.com -

Hallo Herr/Frau

Ich bin eine Finanzgeschäftsfrau, die Ihnen einen schnellen Kredit geben kann. Dies ist ein sehr seriöser und schneller Geldkredit mit einem sehr günstigen Zinssatz, mit dem Sie alle Ihre Geldprobleme lösen können

Bei Fragen kontaktieren Sie mich bitte unter meiner E-Mail-Adresse:

lamacarole849@gmail.com -

canythould43 replied to discussion Already invested in Finbee?Since the platform doesn’t offer a BuyBack guarantee options, you will have to evaluate the risk of your investments. But as an investor, you will hav

-

The platform accepts clients from all over Europe. Clients from the United States and other regions are not eligible for this platform unless they have permanent residency status along with banks account in a European bank.

-

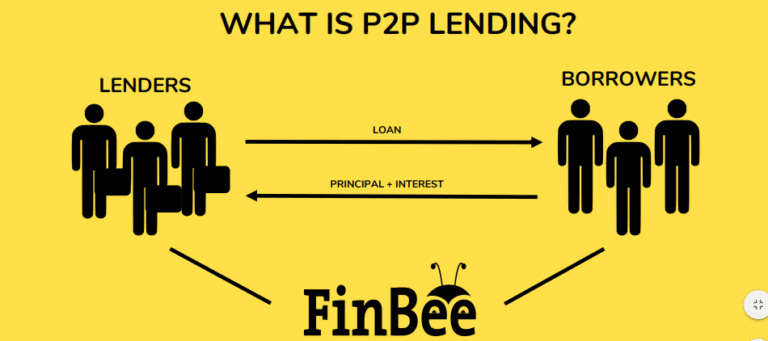

The Lithuania based platform was established in 2015. This P2P platform aims to create profitable opportunities for both borrowers and lenders. The platform connects borrowers with lenders in order to create business opportunities for both sides. The platform has gained popularity amid its higher interest rates. It currently offers close to 20% return on invested capital – which is standing at the higher end of the industry average.

-

canythould43 posted a new link2022 Q3 Report | Finbee https://www.finbee.lt I present to you the investor report of Q3, where we share the platform update plans and detailed statistics of the loan portfolio.

-

-

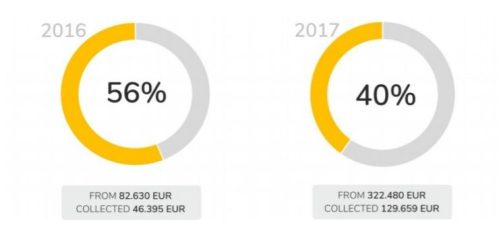

canythould43 added a new photoTill today Finbee has recovered and paid out to their investors 56.15% of invested money in loans that defaulted in 2016 and 40.21% of invested money into loans that defaulted in 2017. Debt collection process is not over, so recovered amount will grow in the future.

-

Finbee report shows that it is probably the only European platform that signs contracts with borrowers by meeting them

personally. This old-school action slows down their lending process but significantly increases payments ethics. By signing a paper contract they also eliminate fraud which is common for online lenders. -

canythould43 posted a new discussion Already invested in Finbee?Already invested in Finbee? If so, share your impressions below. Are you happy with Finbee? Have you encountered an issue that other investors shou ...

-

Finbee is an investment platform in high-yield loans where we will NOT find operations with a Buy-Back Guarantee, but in return we will obtain higher gross returns for our capital.

-

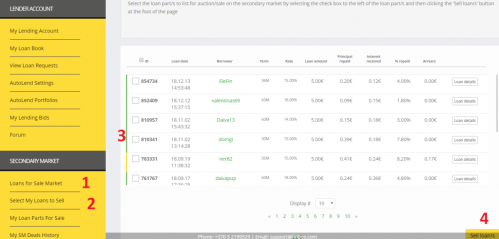

canythould43 added a new photoFinbee puts at our disposal the functionality of Secondary Market to sell our loans and obtain liquidity or to buy bargains and balances from other users. Its operation is very simple, and only has a 1% cost if we want to sell our loans (there is no commission for the purchase).

-

In Finbee we have 4 basic investment modalities, then we will break down and develop each of them:

✰ Manual Investment in the primary market from just 5 euros per operation

✰ 1-click Automatic Investment choosing a predefined strategy

✰ Automatic Investment configuring Autoinvest

✰ Investment in the Secondary Market manually -

canythould43 added a new photoThroughout this time it has accumulated an investment volume of more than 20 million euros, a community of investors composed of more than 11,000 members and one of the best annualized net returns of all European crowdlending platforms, being a very good opportunity to diversify our portfolio.

-

In it we can find from P2P loans between individuals to P2B loans to companies with guarantees of various kinds, making its marketplace one of the richest we have seen in this type of platforms.

-

Finbee , the bee company, is a crowdlending company based in Lithuania, authorized by the Lithuanian Central Bank and created in 2015 that today offers one of the best returns and profitability / risk relationship between platforms that do not have Buyback Guarantee.

-

canythould43 added a new videoA day in FinBee office In early 2018, we’ve opened our door to a film crew and here’s the result. Visit www.finbee.com and check out investing or borrowing opportunities w ...

Since the platform doesn’t offer a BuyBack guarantee options, you will have to evaluate the risk of your investments. But as an investor, you will have more fun than on other “static platform” where you can’t select any special options. In this case you will have to build your risk strategy by doing some calculations.