-

canythould43 ha iniciado una nueva discusión Smartcredito from Spain joins the PeerBerry platformOne more business partner, Smartcredito from Spain, joins the PeerBerry platform. Smartcredito, launched by Aventus Group, will offer PeerBerry ...

-

I want to get a loan ($15K). is there any real lender?

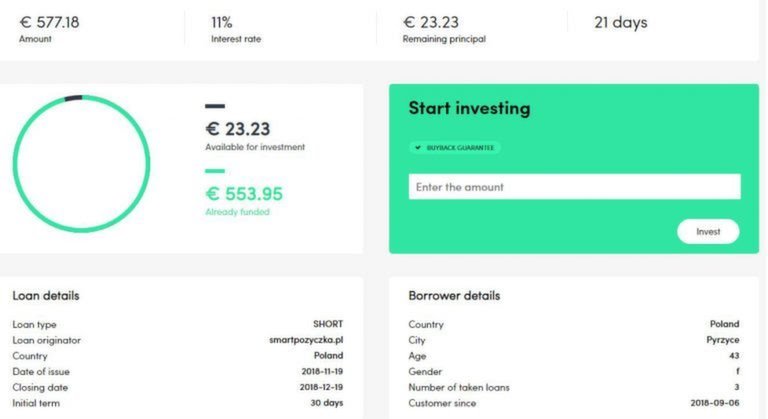

interest rate : 11%

loan duration: 12 months -

canythould43 ha iniciado una nueva discusión PeerBerry partners in Kazakhstan made EUR 4,7 million in net profit in 2022In 2022, PeerBerry business partners in Kazakhstan made EUR 4,7 million in net profit – significantly more than in 2021 (Aventus Group's ...

-

canythould43 ha iniciado una nueva discusión EUR 42,65M of war-affected loans have been repaid to investorsPeerBerry business partners are repaying EUR 1,8 million of war-affected loans. Under the Group guarantee mechanism in 17 months of the war, PeerBe ...

-

canythould43 ha iniciado una nueva discusión Onecredit from Kazakhstan joins the PeerBerry platform | 11% ROIOne more lender, Onecredit from Kazakhstan, joins the PeerBerry platform. Onecredit will offer PeerBerry investors investments in short-term loans ...

-

canythould43 ha iniciado una nueva discusión CashX loans from Sri Lanka are back on the PeerBerry platformStarting this week, CashX loans from Sri Lanka are back on the PeerBerry platform. CashX offers investments into double guaranteed short-term loans ...

-

canythould43 ha iniciado una nueva discusión Peerberry informs about a slight decrease in interest ratesPeerberry informs about a slight decrease in interest rates from June 15 for investing in some loans. Interest on investments in loans from Kazakhs ...

-

Peerberry informs about a slight decrease in interest rates from June 15 for investing in some loans. Interest on investments in loans from Kazakhstan, Moldova, Romania, the Philippines, and Kenya is decreasing by 0.5%. The decrease in interest rates is based on the lenders’ high profitability and/or limited need to borrow. Please note new interest rates considering your investment strategy.

-

-

canythould43 ha respondido a Already invested in PeerBerry?The demand on the PeerBerry platform is high, and many investors face the issue of investing all the funds held in the PeerBerry account.

-

To avoid risks, PeerBerry suspended the listing of CashX loans on the platform in March 2022 due to the deteriorating economic situation in the country. The company successfully continued developing business with its own funds. Since this year, the economic situation in Sri Lanka has been on a positive development trend, and partner CashX is demonstrating good performance results. To date, the CashX loan portfolio amounts to over EUR 2 million.

-

canythould43 ha añadido una nueva fotoStarting this week, CashX loans from Sri Lanka are back on the PeerBerry platform. CashX offers investments into double guaranteed short-term loans with an 11,5% ROI. Sri Lankan loans will be available on the PeerBerry platform three times a week. First loans will be offered today. Make sure to include CashX company in your Auto Invest if this company's offer meets your investment strategy.

-

PeerBerry and its partner Aventus Group continue a strategy to diversify the business by country and bring more diversity to investors. Today, the Czech lender PůjčkaPlus joins the PeerBerry platform.

The company issues short-term non-bank loans with an average amount of around EUR 300. PůjčkaPlus pays much attention to service innovation and reliable relations with customers. The company lends following the provisions of responsible lending. The Czech National Bank supervises PůjčkaPlus activities.

On PeerBerry, PůjčkaPlus offers investments in short-term loans with a 10,5% annual return. PůjčkaPlus loans include a buyback and a group guarantee. -

Nathlite ha respondido a Already invested in PeerBerry?I have had great profitability and I have had a great facility that other platforms have not given me in making my investments liquid. Easy to use,

-

Cheema ha respondido a Already invested in PeerBerry?Generally; Peerberry is easy to use (in half an hour anyone starts investing and earning income), it works well and has a very certified web design. I

-

Outlawking ha respondido a Already invested in PeerBerry?I have noticed since the beginning of 2023 that the number of loans has decreased enormously. My money is therefore not reinvested and no longer earns

-

LoneWolf ha respondido a Already invested in PeerBerry?In my opinion the best P2P Platform that exists. They respond to the chat during operating hours in a very short time and they fix the problem you hav

-

Peerberry is a European P2P lending platform that allows users to invest in consumer and small business loans from various countries. It was launched in 2017 and it is operated by Aventus Group. It offers loans from different originators, diversifying risks for investors. Some of the key features of Peerberry are:

Auto-invest feature

Secondary market for selling loans

Buyback guarantee

Diversification across loans and originators

Low minimum investment

Detailed loan information and statistics -

-

canythould43 ha añadido una nueva foto en el álbum del grupo PEERBERRY Review: Peer to Peer Lending's Photos

-

canythould43 ha añadido una nueva foto en el álbum del grupo PEERBERRY Review: Peer to Peer Lending's Photos

-

✅ Within 5 years of PeerBerry's operation, our investors funded EUR 1,5 billion in loans.

✅ In total, PeerBerry paid out EUR 17,3 million in interest to its investors. -

✅ At the end of 2022, PeerBerry had 63 471 verified investors.

✅ PeerBerry’s outstanding portfolio amounted to EUR 101,18 million. -

✅ In 2022, PeerBerry investors funded EUR 537,5 million in loans.

✅ In 2022, PeerBerry investors earned EUR 7,16 million in interest.

✅ 14 524 new investors joined the platform in 2022. -

canythould43 ha añadido una nueva foto en el álbum del grupo PEERBERRY Review: Peer to Peer Lending's Photos

-

✅PeerBerry's portfolio of investments exceeded EUR 100M today.

✅This year, the investors have already funded over EUR 500M of loans. -

canythould43 ha añadido una nueva foto en el álbum del grupo PEERBERRY Review: Peer to Peer Lending's Photos

-

Vietnamese lender CayDenThan is now listing loans on PeerBerry

CayDenThan VN started offering loans with a 12% annual return, backed by a buyback and group guarantee. CayDenThan VN is a joint venture of Aventus Group and GoFingo Group in Vietnam. -

canythould43 ha respondido a Already invested in PeerBerry?Recently PeerBerry repaid EUR 1.8 million under the group guarantee to compensate investors for war-related loans from Russia and Ukraine.

-

-

I am very much interested in 50/50 partnership equity with the total amount of 1,3 Billion property projects. I will submit the information on the request. if there is a serious business dealer inbox me as soon as possible.

-

canythould43 ha publicado un nuevo enlacePeerBerry's portfolio exceeded EUR 100 million - Peer to peer lending marketplace - PeerBerry https://peerberry.com No description

-

canythould43 ha publicado un nuevo enlacePeerBerry is receiving the crowdfunding license in Lithuania - Peer to peer lending marketplace - PeerBerry https://peerberry.com Aucune description

-

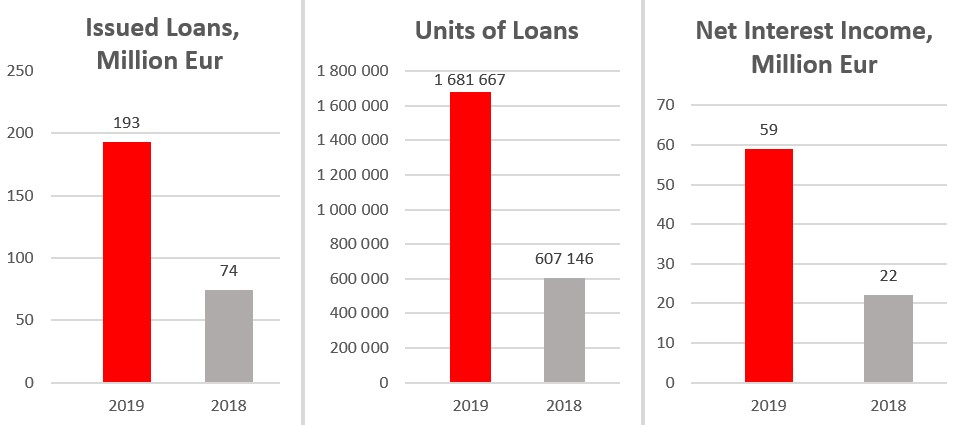

Gofingo is one of PeerBerry business partners with almost 15% share of loans listed on PeerBerry. In 2019, Gofingo Group companies issued 35,88 million Eur of loans – 2,4 times more than in 2018. The total loan portfolio of the Group at the end of 2019 amounted 6,6 million Eur. At the end of 2018 the total loan portfolio amounted 2,75 million Eur.

-

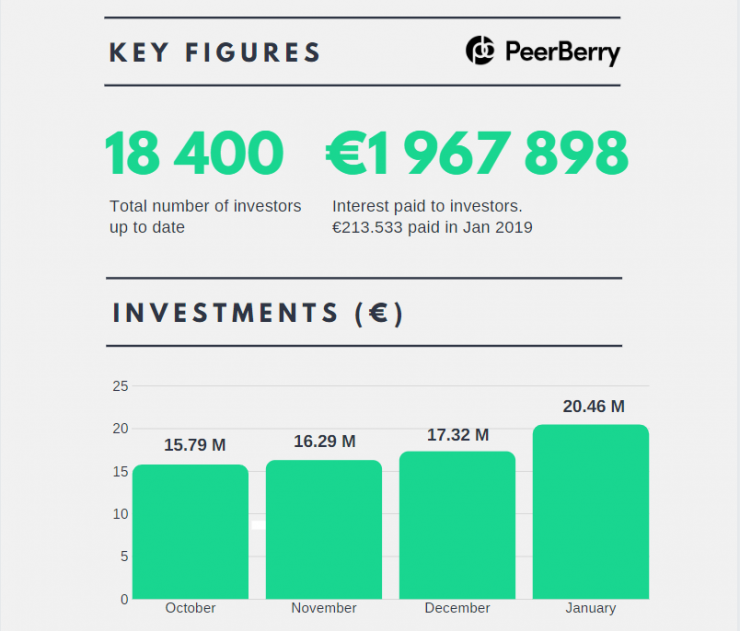

canythould43 ha añadido una nueva fotoDuring January this year, 1,400 new investors have joined to the PeerBerry investors community – 20% more than in previous months. PeerBerry currently has more than 18 400 investors who are enjoying investment opportunities at PeerBerry.

-

Peerberry seems like a very new platform and inexperienced with P2P lending due to its launch on the 1st of November 2017. However, this platform is an extension of Aventus Group which has years of experience in lending, half a million customers and 18 million loan portfolio. They have been profitable for the past 9 years which is a testament to the stability and reputation.

-

canythould43 ha publicado un nuevo enlaceAventus Group business review of 2019Aventus Group business review of 2019 - Peerberry https://blog.peerberry.com No description

-

canythould43 ha añadido una nueva fotoIn 2019, Aventus Group companies issued 193 million Eur loans – 2,6 times more than in 2018. More than one million – 1 681 667 units of credits (including credits with prolongations) in total were issued during the year 2019. It is 2,8 times more in comparison with credit volumes in 2018.

-

There’s no secondary market or a way to sell back your loan to PeerBerry before the loan term.

For the short-term loans, this is not a big issue, because they mature in at most 45 days. Most of the loans on PeerBerry are late by 30-60 days, but even with that, you can get a hold of your funds in at most 3 months.

For the long-term loans. If you invest in a 5 years loan, you’ll need to wait for 5 years before exiting the PeerBerry platform. -

canythould43 ha añadido una nueva fotoOnce you click on a loan you’re interested in, you get a bit more details about the borrower. The details contain their age, sex, country and how many loans the borrower already has. You can also see the loan originator details, interest rate, remaining loan term and if the loan has a buyback guarantee policy or not.

-

-

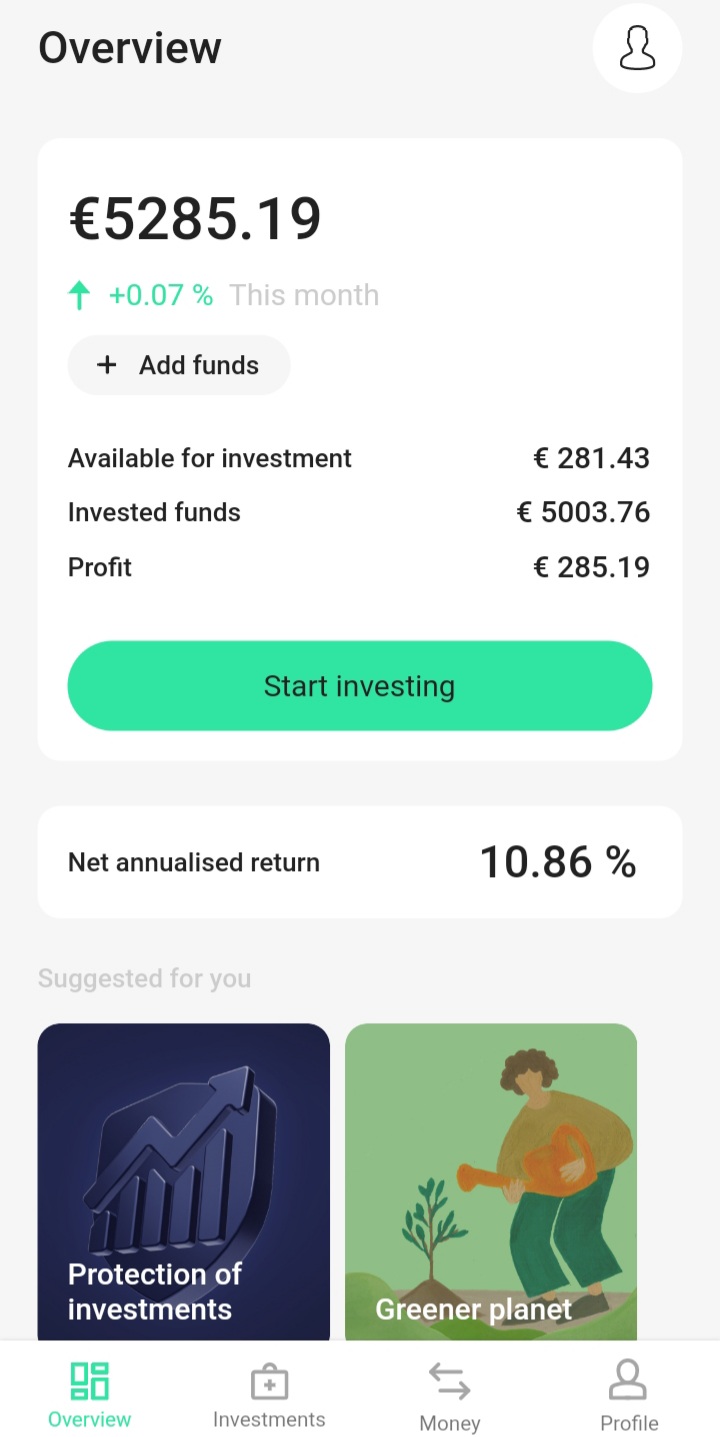

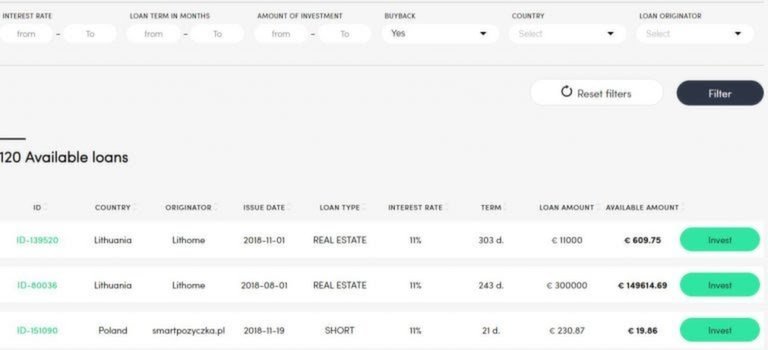

canythould43 ha añadido una nueva fotoOn the Invest page, you get a list of available loans, with interest rates around 10-12%. Most of the loans available are short-term, although I’ve also seen a few that have more than 12 months terms.

You can also filter the available loans by interest rate, loan term, the amount available for investment, country, loan originator and if the loan has a buyback policy or not. -

The Aventus Global group has a fairly strong financial position, with almost €20 million of equity, and €5.8 million of profit for the first half of 2019. Most loans offered on Peerberry currently come from two lending groups – Aventus Group and GoFingo.

The demand on the PeerBerry platform is high, and many investors face the issue of investing all the funds held in the PeerBerry account.